I recently helped my parents buy a car, and I understand why people hate the whole process. It’s time consuming, confusing and expensive. But it doesn’t have to be so bad! Hopefully this piece will make buying a car less intimidating and break it down to an easy step-by-step process.

TLDR: Buying a car can be scary. But once you have clear goals, it’s not so bad. The main steps are: have a budget, know the car you want, test drive it, get a loan, put in a down payment, sign documents and you are on the way! That said there are often “hidden” costs like taxes, insurance, gas and maintenance.

Where do we start?

Below is a checklist of things to do when buying a car. The steps are (in order):

1. Set a budget – this is how much you want to spend.

2. Find a car (or cars) that interest you and fit your budget.1

3. Find a nearby dealership and walk in/email/call them to set up a test drive.

4. Test drive the car and get the salesperson to print/email the car’s OTD (out the door) price.

5. Repeat steps 3-4 for every car that interests you.

6. Rank the cars you like and write down/type the OTD price of each.

7. Figure out how much money you want to borrow.

8. Check your credit score at the credit reporting companies (Experian, Equifax and Transunion).2

9. If you don’t have a login/account, start one. If your credit is frozen, unfreeze it.

10. Apply for a loan at a bank, credit union or other lender.3

11. Take a screenshot of the loan approval letter/print out a copy of the approval letter.

12. Call/email/walk into the dealership where your target car is.

13. Tell the salesperson what you are willing to pay, OTD (out the door).

14. If they agree, great! If not, go to another dealer with a similar car/next car on your list.

15. Repeat steps 12-13 until you succeed.

16. Sign a bunch of documents and give down payment at the dealership.

17. Leave the dealership with your new car.

18. Contact your insurance company/broker to update your insurance

What is my budget or how do I set it?

I’m not you, so I have no idea. But let’s say, for example, $25,000 including taxes and fees.

Wait, taxes and fees? How much are they?

Your state charges you tax when you buy a car. A rule of thumb is to add 10% for taxes and fees. So, if a car costs $25,000, after taxes and fees are included, it’s probably around $27,500 ($25,000 + 10%).

So, if I have a budget of $25,000, then the cost of my car before taxes should be like $23,000-ish?

Yep.

What are other things I need to think about when setting my budget?

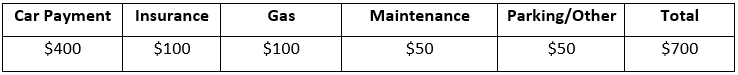

There are a bunch of factors, but a few might be: how much money you make, your current monthly expenses (rent, groceries etc), how much cash you have in the bank and how stable your job is. Making monthly payments on a car (if you get a loan) is one thing. Other factors are: gas, maintenance, and insurance. It’s worth writing down your estimated monthly car spend.4 A rough example is below.

It looks like paying for stuff that’s not just my car adds a lot to my monthly spend.

If you have a nice car and a loan with a high interest rate, your monthly car payment might be more than above. Insurance companies may charge more, too. This is because if your new car gets in an accident, the insurance company has to pay you more than it would for an old car. Gas can change depending on how much you drive or the kind of fuel you use, or if you have a hybrid/EV. Maintenance is a tough one to guess. Best to look it up on the internet. If you live in a city or work in an office, you are also probably paying for parking.

How do I find a car that I want/need?

What do you plan to do? Commute on normal roads? Drive fast? Haul around family or lots of stuff? Drive in the snow/off road? Do you care about looks, reliability or speed? Answering these questions will point you in the right direction. Still unsure? Ask Google, ChatGPT or Reddit.

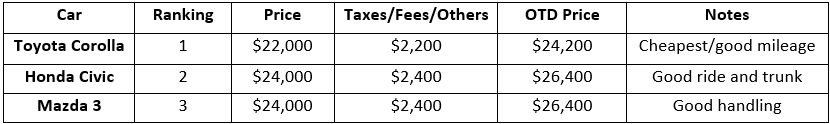

Can you give me an example?

Let’s say you want a car that is reliable, easy to fix, and that you are not racing or doing donuts in the snow. Let’s also say that you don’t have to lug tons of stuff and don’t have 7 kids. Maybe a Toyota Corolla works.5 Now you can go to Google, ChatGPT and Reddit or ask friends/family. My Google results were: Honda Civic, Mazda 3, Volkswagen Jetta, Kia Rio, Subaru Impreza, Nissan Versa.6

Then what?

Go to Toyota’s website and put in your zip code to find dealers near you or look it up on Google Maps. Email/call/walk in and talk to a salesperson about the car you want. Tell them the car you want to test drive. They will probably ask you for your contact details and your driver’s license to make a copy. They will usually join you for a test drive and explain the car’s features.

How does the car drive? Are you comfortable? Do you like the display panel/sound system? Are the backseat and trunk big enough? If you are still interested, ask for an OTD or “Out the Door” quote.

You keep saying OTD or “Out the Door” Price. What is this?

This is the “If I had to buy the car in CASH MONEY RIGHT NOW, how much would that be?” price. The OTD price includes the cost of your car, any other options that come with it as well as taxes and fees.

Ok, then what?

Go test drive the next car on your list. Repeat until you have driven and ranked each car.

Can you show me a car ranking example? This is kind of confusing.

Sure. See below.

What if I don’t care which car I get?

Then you can negotiate with everyone and just shop on price/convenience. Advantage, YOU.

I need a loan. What is this about freezing/unfreezing your credit?

If you have a credit card or loans (like a mortgage or student loan), you have a credit file. That information, along with your payment history, how much you owe etc., is stored at companies called credit bureaus. They are: Experian, Equifax and Transunion. This is where banks and other lenders pull your data from to make decisions like how much to lend you and how much interest to charge.

You may have heard in the news that one or more of those companies were hacked. As a result, experts suggested people “freeze” their credit, so that even if your data was stolen, that the bad guys would not be able to get loans in your name. In order to get a loan, you need to have your information open and accessible to lenders, so they can see your information and make you an offer.

Even if you don’t have an account at any of the bureaus mentioned above, your credit information is still there, so it’s worth making an account and its free. It’s also how to check your credit score. If you froze your credit, you can unfreeze it (even temporarily) when you are ready to apply for a loan.

I made an account at those bureaus. My credit is fine. It’s also unfrozen. How do I apply for a car loan?

Go to your bank or credit union’s webpage and follow the links/directions to apply for a loan. You’ll have to input things like your name, address, social security number, annual income, whether or not you own/rent your home and how much money you want to borrow. If it’s a big bank, a computer decides and you’ll quickly get an email. You can also go to Nerdwallet or other websites to find other lenders.

Typically, down payments for cars are 10%-20% of the car price. If your car costs $25,000 OTD, you can apply for a $22,500 loan. You can make a bigger down payment if you want.

I got my loan approval(s)! Now what?

Score! Take a screenshot of the official letter on your phone. What it should include is the amount of the loan, the interest rate and an “Approval Code.” Print out the letter when you go to the dealer.

I hear that your credit rating goes down when you apply for a loan?

Your credit score may go down 5-20 points. However, if you apply for a car loan at one place, you can, within a month, apply for car loans at other places without damaging your credit score further. Additionally, your credit score recovers within a few months, as long as you pay your bills on time.

I’ve tried a bunch of cars, set a budget, gotten a loan approval and know what car I want. Now what?

Go online to see which dealership has the car you want. Email/call/visit them. Tell the salesperson what OTD price you want to pay. They will either accept, give you a counteroffer, or say no. If they accept, set a time/date to visit the dealer. Bring a check (or bank account information) for a down-payment, your loan offer letter, driver’s license and insurance card. There are some dialogues at the end of this paper to give you an example of what’s said at the dealer.

What happens at the dealer?

You will meet the salesperson. There will be smiles and congratulations because you are about to get a new car and they are about to get paid. They may try to sell you a bunch of other stuff you probably don’t need (more on that later). The salesperson will show you the car, you’ll do a walk around and see the inside and outside of the car, you will sign your name a bunch of times, finalize the down payment and go to the finance office.

Finance office? What?

This is a separate part of the dealership with different people. These people try to loan you money and sell you extended warranties and other overpriced things you probably don’t need.

The finance person will ask about the down payment and loan details, like how many years you want the loan to be. They will plug a bunch of numbers into a computer and get you a loan offer. If the interest rate is lower than the one from your bank, take it. Otherwise, give them your loan approval letter and ask them if they can match it. The dealership might do it. If so, it’s your call. If they don’t, just tell them that you’ll use the loan from your approved lender. You will sign a bunch more documents and give them the down payment.

What if I am actually interested in an extended warranty or service package?

I strongly suggest you do internet research to determine what you need and a fair price before making a decision. I repeat, do this BEFORE you go to the dealer. Pricing can vary a lot between dealers. If you are convinced you need one of these things, you can almost always buy it AFTER you take the car home.

Then what?

The salesperson and manager shake your hand, give you the keys and you drive away into the sunset.

OK, I caved into sales tactics and bought one of those warranties and am having second thoughts.

It happens. These people are fantastic at sales. You can usually cancel these things within 30 days. Call your dealer, ask to speak to someone in finance and say that you want to cancel. Be ready to get a sales pitch or for them to offer to call you back. They may delay and, of course, not call you back. You may have to go back to the dealer to sign some papers. Keep at it.

What about my trade-in?

Treat it as a separate deal from buying a car. Shop around to see what your car is worth before trading it in. No time? You can accept what the dealer offers and that amount comes off the price of your new car.

What about insurance?

If your down payment is big enough, you can drive off with the car and call your insurance company later. You are probably going to have to pay more monthly premiums since it’s new car. If your down payment is not enough, you may have to get some temporary insurance.

People keep talking about what my target monthly payment is rather than budget. Why?

You are probably being upsold. The trick is to sell you things you don’t need or a more expensive car. The dealer gets more money and your loan is a longer tenure (say 7 years instead of 5) but you will be paying the “same amount per month.” This means that you pay more money in the end. Don’t fall for it.

Ok can we get some dialogues on how things actually go when you buy a car?

Sure. See below.

Visiting the dealer

You – Hi. I emailed/called earlier and am interested in a new Toyota Corolla.

Receptionist – Sure! Let me get Sally (the salesperson).

Sally – Hi! I hear that you’re interested in a Corolla. Did you just start looking for a new car? How about a test drive?

You – I’ve just started looking, and yes, I’d like to do a test drive.

Sally – Great. I need to make a copy of your driver’s license. Give me a minute and we’ll head out.

(You give Sally your driver’s license and she comes back a few minutes later)

Sally – Let’s go for a spin.

(You drive the car, Sally talks about the car and its features. Afterwards you get out of the car)

Sally – What did you think? Are you looking at other cars? Any trade in? Would you finance the car?

You – I’m looking at a Mazda 3 and Honda Civic. Unsure about trade in. We can talk financing later.

Sally – Sure! Those are nice cars. Here’ s my card; keep in touch.

You – Thank you. Can you please give me an OTD quote on this car please?

Sally – Of course, give me a sec.

(Sally comes back with a printed sheet of paper) – an example is at the end of this piece.

Buying a car. Success!

You (on phone or in person) - Hi, may I speak to Sally in sales?

Receptionist – Sure! I’ll transfer you to her.

You – Hey Sally, I like the Corolla and would be happy to buy if the numbers work out.

Sally – Sounds good. Do you have a trade in? Will you be financing?

You – No trade in, but if the price is right, we can discuss financing later.

Sally - What are you thinking?

You – I can do $500 below your OTD price quote of $25,000 and I can close today.

Sally – Ok. Let me talk to my manager. He/she makes the decision on this.

(Some time passes. 30 seconds to 15 minutes or more; sometimes they call you back later)

Sally – My manager accepts. Can I get a copy of your license and insurance to begin the paperwork?

You – Sure.

(Sally fills out some papers and briefly explains the purpose of each one)

Sally - Sign here, initial here. Are you going to finance today?

You – I’m happy to discuss that.

Sally – Great. I’ll get you over to Bill in finance to go over the details there.

In the Finance Office

Bill – Congratulations! We have some great financing rates (this means interest). How much are you looking for a down payment and what term (how many years) are we thinking?

You – I can put down 15% and would like to see what you can offer for a 5-year loan.

Bill – Let’s get some information from you. We get offers from banks and are very competitive.

(a few minutes go by)

Bill – We can offer you an 8% interest rate at 5 years.

You - I can borrow for 7% from my lender. Can you match that?

(You show Bill your loan approval letter. Bill enters information from you letter into the computer)

Bill – Let’s see… We can match that.

You – Great! I’m happy to finance with you (borrow money from you or one of your partners).

Bill – Let me put this through and get some papers ready. Now, you are going to need to take care of your car. Here are some great extended warranties and service packages. This covers wheels, this one covers engine, this one extends your warranty for the low price of… blah blah blah

You – You know what? I’m set for now. I’ll do some research and get back to you.

Bill – We offer great prices, and you want to take care of that car. Let me tell you more. Blah blah

You – Thanks, but I am set for now. I’m happy to sign the documents and finish up here.

Bill – Ok. We are done here.

(You both sign some documents. Bill quickly explains each one)

Bill – Congratulations!

(You both walk out of the finance office)

Sally and Sales Manager – Congratulations! Here are your keys. Have a great day!

Buying a car. Unsuccessful attempt

You - Hi, may I speak with Sally in sales?

Receptionist – Sure! I’ll transfer you to her.

You – Hey Sally. I like the Corolla and would be happy to buy if the numbers work out.

Sally – Sounds good. Do you have a trade in? Will you be financing?

You – No trade, but if the price is right, we can discuss financing later.

Sally - What are you thinking?

You – I can do $2,000 below your OTD price of $25,000 and close today.

Sally – I have to ask the sales manager. It might be tough. This is a popular car. I’ll get back to you.

(Some time passes. 30 seconds to 15 minutes or more; sometimes they call you back later)

Sally – I just talked to my manager. We can meet you halfway at $26,000, but you have buy today.

You – I appreciate that, but I have a budget. I have to think about this.

Sally – I understand.

Do not be surprised if Sally calls later. She may give in to your price or give another counteroffer.

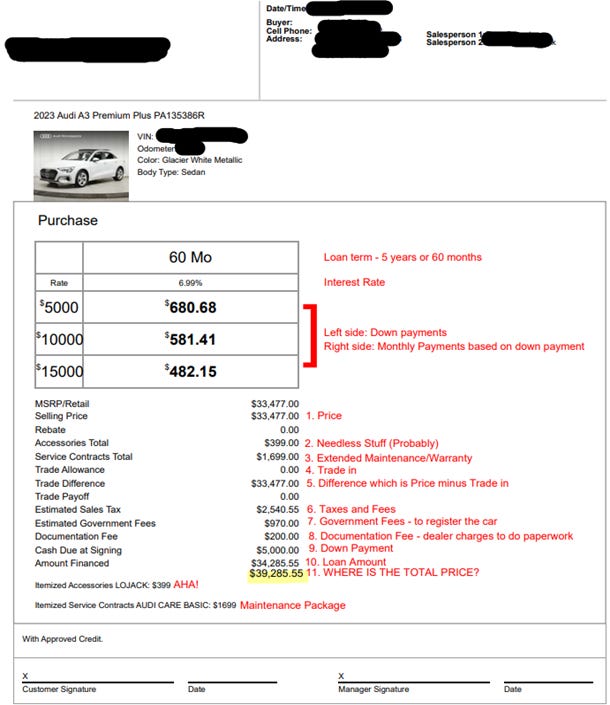

This dialogue is nice, but can you show me what an offer sheet looks like and what things mean?

Sure. See below. Neither my parents nor I purchased an Audi A3. This is just an example.

OFFER/OTD Sheet

It’s kind of weird, but look at number 11 to start. That’s the total or OTD price. I put that in there, to show it to you, but it’s often not included. It’s probably some psychological thing to make you feel like you are spending less money than you are.

1. This is the price at which that the dealer will sell you the car. - Negotiable

2. These are accessories. In this case it’s LoJack (see “AHA” on the lower left side of the page). In other cases, it can be paint protectant or something else. This is a great way for the dealership to make money. – Negotiable or can decline.

3. This is a maintenance package where whatever routine maintenance you may have in the future (every 5-10k miles) is covered for some period of time or the number of miles you put on the car. Note how this and number 2 are ABOVE the taxes/fees. This means that if you buy them, you will also be taxed on them which makes your car even more expensive. – Negotiable or can decline

4. This is what you would get for a trade in, if you have one. This would subtract from the price that you pay. - Negotiable

5. This is the price you will pay for the car minus your trade in but before the accessories.

6. These are taxes, usually levied by your state. The amount differs by state. – Not negotiable

7. Government fees are the costs to register your car with the state – Not negotiable

8. Documentation fee is what the dealer charges to do the paperwork for you – Not negotiable

9. Down Payment – you can put down as much or little as you want. This will affect your monthly payments going forward since it affects your loan amount and interest rate. – Negotiable

10. This is the amount of money you are borrowing to buy the car.

This is the total price of your car (the sum of numbers 9 and 10 in the sheet). Not how the font is different. This is because I put it in there and the dealer did not. Dealers often don’t. UGH

Here are the links to the credit bureaus: Experian, Equifax and Transunion

The bank where you have a savings or checking account is a start. You can also try NerdWallet.

This is just an example; I randomly made up numbers

Not an advertisement for Toyota Corolla

Also, not an advertisement for these cars