What are Call Options and how do they work? What you need to know.

There’s a lot of confusion when people talk about stock options. Many understand the basics of how stock options kind of work, but they fail to grasp how one can lose money with options (specifically call options). In this paper, I am going to, at a basic level, explain stock options, how they work and what affects their value. This paper assumes zero knowledge of finance.

TLDR: Call options give you the right to buy stock at a set price for a set period of time, like a month or a year. They can be a lower cost way to invest in a stock but come with risks and you can lose a lot of money, often all of it! Usually, one loses money with call options because time runs out and/or because one pays too high a price.

Where do we start?

Most of the time when people talk about financial markets and investing it’s about buying stocks. But you can also invest in stocks by buying stock options. As a result, this essay will focus on stock options, specifically call options.

What are call options?

A call option gives you the right to buy a stock at a certain price within a certain period of time. For example, you may think that Apple stock will be higher a year from today. You could buy some Apple stock, or you could buy a call option that would give you the right (but not the obligation) to buy Apple stock at any time over the next year at a set price, regardless of how Apple’s stock price moves in that time.

Can you give me an example?

Let’s say that Apple stock is at $2001 but you think that it will go to $300 in the next year. You can buy a 1-year call option which gives you the right to buy Apple stock at $200 anytime over the next year. If Apple stock is higher than $200, say $300, then you probably use that call option to buy Apple stock at $200 and then immediately sell that stock for $300 in the market, making $100 in profits.2 If Apple stock is less than $200, say, $100, then you don’t use the call option to buy Apple stock because you could just go to the market and buy Apple stock at $100, if you wanted, rather than $200 with your option.

But if you think that Apple’s stock price will go up, why not just buy Apple stock?

The simple answer is that buying Apple stock and it not doing well could lose you more money than just buying a call option. Let’s use the example above. Apple stock is at $2003 but you think that it will go to $300 in the next year. You could buy the stock, but what happens if Apple stock has a bad year, and its price goes down to $100? You lose $100. But if you bought a call option (which probably costs a lot less than $100 – let’s say, $20)4, and the price of Apple stock goes down or you change your mind, you could sell your call option (at a loss) and get some money back. Or you could just hold the call option and in a year it would be worth nothing. You lose $20. Losing $20 is better than losing $100.

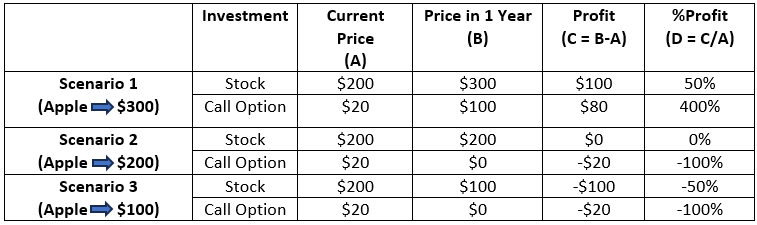

Can you put this in a table? This is kind of confusing.

Sure.

Wait, but in Scenario 1, if Apple’s stock price goes to $300, and the call option lets me buy at Apple stock at $200, doesn’t that make the option worth $100, which should be my profit?

No. Remember that you paid $20 for the call option in the first place. You paid $20 and the call option became worth $100. The call option is worth $1005 because Apple stock went to $300 and the call option lets you buy Apple for $200. You sell the option for $100 (or buy Apple for $200 and then sell it for $300), making $80 profit ($100-$20 = 80).

I can make like 4 times my money and put less money up with a call option? I should do this all the time. Screw stocks.

Yes, as shown above in Scenario 1, you can totally make a lot of money. But..

Sigh, this is where you tell me how I can lose money with call options, right?

Yes! Note that in Scenario 2 and Scenario 3, if you bought a call option you lost all of your money.

You know what really sucks? Scenario 2, because you lost all of your money, even though the price of Apple stock didn’t change. So how did you lose money? Remember that your call option had a time limit, specifically 1 year. You were betting that Apple’s stock price would go up within a year, not a second later. And it didn’t. However, if you bought Apple stock, you wouldn’t have lost money.6

You lost money in Scenario 3 whether you bought Apple stock or a call option. Why? Apple’s stock price went down. Additionally, you ran out of time for the call option. Just to add a twist: What would happen if 2 years from now, something crazy happened and Apple stock went from like $100 to $400? Well, you would make money if you had Apple stock. You bought for $200 today, 1 year later it was $100, but you didn’t sell, and 2 years later it was $400. But if you bought a 1-year call option, you would have run out of time after 1 year and would have lost all of your money.

And this is where people can get in trouble. Because you can put up less money to buy call options, some people end up using the same amount of money to buy call options as they would to buy stock. And with call options it’s really easy to lose ALL of your money (as shown in the table above), whereas with stock you probably won’t lose all of your money unless the company goes out of business or something.

Time seems to be a big deal when it comes to call options.

Yes. Every day that passes is one less day for the stock price to move in your favor. Remember that call options have a time limit. Like if you buy Apple stock, you can sort of chill and hang out and maybe one day it will make you a lot of money if the company launches a new revolutionary Smart AI device or continues its quest of world dominance. But if you buy a 1-year call option on Apple stock, then after a month, there are only 11 months left. This means that there is less time for the stock to move enough for your option to be worth anything. All else equal, as time keeps progressing, your call option becomes worth less and less.

And the other way you can lose money with call options?

Like in Scenario 3 above, the stock price could go against you. In this case, if Apple stock goes down, then your option is worth less money, right? Like the stock has to go up even more for your option to be worth anything.

Another way to lose money on call options is if the stock’s volatility is lower than expected.

Volatility? English, please.

Volatility is a fancy way of saying “how much a stock price moves.” The more the market expects the stock price to move, the higher the expected volatility of the stock and therefore the higher the price of the call option. Why? Because the more a stock price moves, the better the chance that the stock price could go up and make your call option worth more.

Other things that can impact a stock’s potential volatility include: how much the stock has moved in the past, how much the overall stock market has moved in the past, potential upcoming events, like the release of a new product or earnings announcements. Simply put - the higher the expected volatility of the stock, the higher the price of the option.

So, time and stock price volatility are really important. How are call options valued?

Books and academic studies have been done on this, and it is beyond the scope of this essay. Essentially, a call option’s value is a combination of the stock price today, the stock price at which your call option lets you buy the stock (known as the “strike price”), the stock’s expected volatility and the amount of time on the option.

A 1-year call option will cost more than a 1-month call option because there is more time for stuff to happen for the stock to move in your favor and because the future is uncertain. A more volatile stock’s call option will cost more than a not volatile stock’s option.

However, the banks, brokers and hedge funds that buy and sell options for a living have more advanced pricing models and insight into call options and how they are traded than you and me. You can be sure that if you are trading call options, that the pricing is not skewed in your favor.

Like that $20 call option used in the example earlier in this essay? They may sell it to you for $22 or $25. That price difference may seem small to you, but over millions of trades, it adds up to a lot of money… For them, to make off of you and your friends.

How about those like 1-week or 0-day options people on Reddit or my friends keep buying?

These are essentially lottery tickets. If the stock somehow moves in your favor in a week or a day, you can make a lot of money and fast. The banks, brokers and hedge funds that sell you these options know this and will price these options such that you will usually overpay and lose money the vast majority of the time. Sure, you might strike the jackpot, but you could do the same in Vegas/Macau/Monte Carlo.

Apple’s stock price is $175.01/share as of September 15, 2023, but I’m just trying to keep the numbers simple.

Actually you probably just sell the option which will be priced at around $100 and never go through with buying and selling Apple stock.

See number 1 above.

Like $21.90 per share. Source: https://www.nasdaq.com/market-activity/stocks/aapl/option-chain, expiration September 2024

To keep things simple, this assumption is based on the option’s last day, just before it expires. If Apple stock goes above $300 within a year, then the option is probably worth more than $100, because the option has time on it left and Apple stock could maybe go even higher.

You would have made a little money from a dividend. Apple’s current dividend is $0.24 per share. Whoop de doo.